MASSACHUSETTS

Home Sales Up, Average Price Up

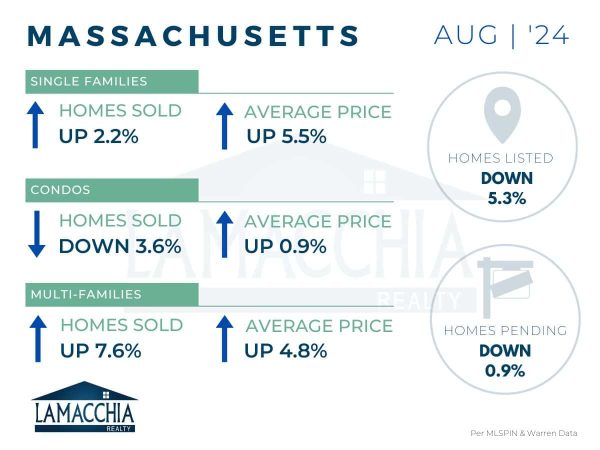

Home sales are up 1.0% year-over-year, with August 2024 at 6,911 compared to 6,840 last August. Sales are up for Single and Multi – Family homes. Sales are down for Condos.

- Single families: 4,404 (2023) | 4,499 (2024)

- Condominiums: 1,871 (2023) | 1,804 (2024)

- Multi-families: 565 (2023) | 608 (2024)

Average sale price increased 4.4% year-over-year, now at $742,718 compared to $711,386 in August 2023. Prices increased across all categories.

- Single families: $736,271 (2023) | $776,757 (2024)

- Condominiums: $664,284 (2023) | $670,262 (2024)

- Multi-families: $673,387 (2023) | $705,827 (2024)

Homes Listed For Sale:

The number of homes listed is down by 5.3% when compared to August 2023.

- 2024: 5,989

- 2023: 6,325

- 2022: 7,078

Pending Home Sales:

The number of homes placed under contract is down by 0.9% when compared to August 2023.

- 2024: 5,898

- 2023: 5,949

- 2022: 7,609

Price Adjustments:

The number of price adjustments is down 1.2% when compared to August 2023.

-

- 2024: 499

- 2023: 505

- 2022: 700

Data provided by Warren Group & MLSPIN then compared to the prior year.

What’s Happening in the Market?

- Despite the national housing market trends having a slight decline in home sales, Massachusetts still saw a sales increase overall when compared to August last year.

- Massachusetts did see a decline in condo sales compared to last year, following the national housing market trends. Indicating weakening demand.

- Buyers, as we enter the fall market, it is expected that buyer competition will decrease, making now the best time to purchase a home. Anthony explains why in this video here!

- There were minimal fluctuations in mortgage rates in the month of August. According to Mortgage Daily News, rates remained within the 4% to 6.6% range. Then, in early September, we saw them drop to the lowest rate since February 2023 at 6.1%. Due to the Federal Reserve’s recent 0.5% rate cut, we can anticipate a potential further decline as the year progresses.

- Sellers, with the trends of mortgage rates and new inventory on the decline, now is a great time to list. There will be motivated buyers looking to settle before the holidays.